Investment Management

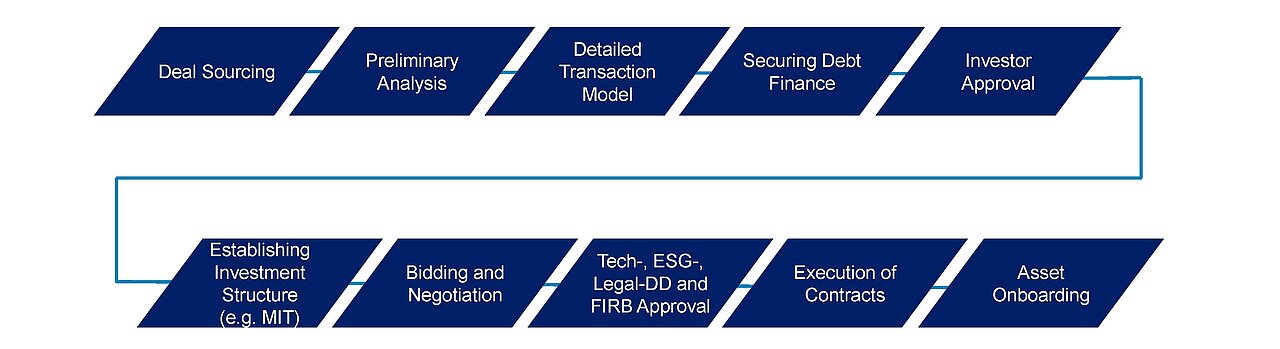

Real I.S. Australia offers flexible process management

With extensive local market knowledge and significant access to off-market transactions, we manage a variety of direct property assets in Australia for our suite of investment funds as well as for third party investors.

Active Asset Management

Diligence and Commitment across the Entire Property Life Cycle

Real I.S. Australia manages a portfolio of 1.0 bn. A$ with 119,743 square meters lettable area. Proof of successful management and the basis of sound return and sustainable development are reflected by the high average occupancy rate of 97.8% and a 6.1 year WALE.

We understand the specific requirements of our investors to successfully source tailored, premium investment opportunities. Through ongoing market monitoring and benchmarking, as well as our well established network, we are able to continuously adapt to the dynamic market environment. Real I.S. Australia's Asset Management philosophy is built on the foundation of strong tenant relationships, early and transparent communication as well as detailed strategic planning. We are well versed in larger whole-building Government leasing transactions. With the team securing long term (>5yrs) Government renewals across four assets and totaling 138,727sqm of space.

Through the active management of our portfolio we maximise returns for investors. Utilising a strong foundation of extensive market analysis as well as an in-depth understanding of tenant requirements and unlocking untapped potential.

Our team is experienced in delivering projects varying from $50,000 to $50m+ in value, ranging from architectural improvements to base building services upgrades.

Projects that we have delivered include:

- Full building refurbishments in a live, high security environment

- Make good of outgoing tenants

- Base building services upgrades

- End of Trip (amenities) upgrades

- Speculative Suite fit outs

- Aluminium Composite Panel (ACP) replacements

- Regulatory upgrades

We believe in early engagement with tenants to develop asset improvements which benefit the building value as well as leasing activities. Such improvements include the uplift of end-of-trip facilities to modern standards and refurbishment of ground floor lobbies to improve user experience.